How Credit Repair Can Modification Your Life: What You Must Comprehend

How Credit Repair Can Modification Your Life: What You Must Comprehend

Blog Article

Comprehending Just How Credit Repair Works to Improve Your Financial Wellness

The procedure incorporates determining mistakes in debt reports, challenging mistakes with credit rating bureaus, and bargaining with lenders to deal with outstanding financial debts. The question remains: what particular strategies can individuals use to not just remedy their debt standing but likewise make certain long-term monetary security?

What Is Credit Repair Work?

Credit report repair refers to the process of boosting an individual's creditworthiness by resolving inaccuracies on their credit rating report, bargaining financial obligations, and adopting far better financial routines. This complex approach aims to improve a person's credit rating score, which is a critical element in protecting loans, bank card, and positive rates of interest.

The debt repair process usually begins with a complete evaluation of the person's debt record, permitting for the recognition of any kind of mistakes or inconsistencies. Once inaccuracies are pinpointed, the individual or a credit history repair work professional can initiate disputes with credit bureaus to remedy these problems. In addition, discussing with lenders to settle arrearages can better enhance one's financial standing.

In addition, embracing prudent economic practices, such as prompt expense settlements, minimizing debt use, and maintaining a varied credit history mix, adds to a healthier credit rating account. Overall, credit rating repair service acts as a vital method for people seeking to gain back control over their financial health and wellness and secure far better borrowing chances in the future - Credit Repair. By taking part in credit rating repair service, people can lead the way towards achieving their monetary objectives and boosting their overall lifestyle

Usual Credit History Record Errors

Errors on credit score records can significantly affect a person's credit score, making it crucial to recognize the common types of inaccuracies that may develop. One widespread concern is wrong personal info, such as misspelled names, wrong addresses, or inaccurate Social Protection numbers. These mistakes can lead to confusion and misreporting of creditworthiness.

Another common mistake is the coverage of accounts that do not belong to the person, usually due to identification theft or clerical blunders. This misallocation can unjustly reduce an individual's credit rating. Additionally, late payments might be improperly tape-recorded, which can occur due to payment handling mistakes or inaccurate reporting by loan providers.

Credit score limits and account equilibriums can also be misstated, leading to a distorted sight of an individual's credit score utilization ratio. Recognition of these common errors is critical for effective debt monitoring and repair work, as addressing them without delay can help individuals preserve a much healthier monetary account - Credit Repair.

Actions to Dispute Inaccuracies

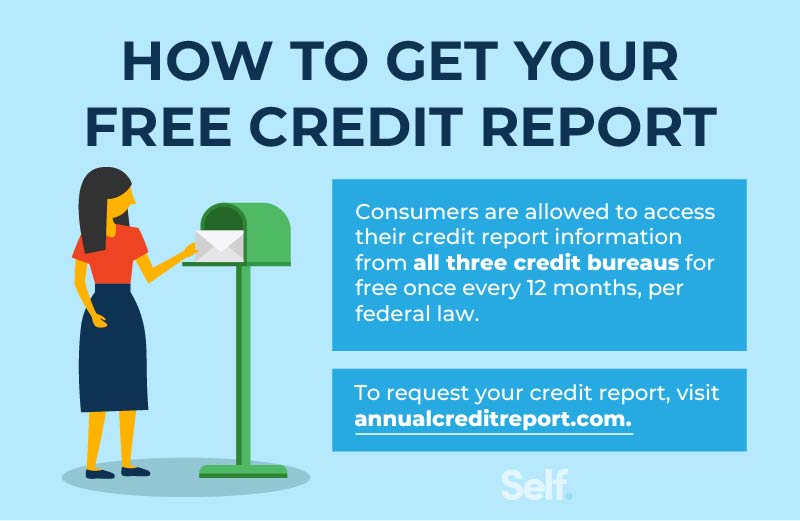

Contesting mistakes on a credit rating report is an essential process that can help restore an individual's credit reliability. The initial action involves obtaining a present copy of your debt report from all 3 major credit report bureaus: Experian, TransUnion, and Equifax. Testimonial the record diligently to recognize any kind of mistakes, such as wrong account details, balances, or payment histories.

Next, launch the conflict procedure by calling the appropriate credit scores bureau. When submitting your disagreement, clearly lay out the mistakes, give your evidence, and consist of personal recognition info.

After the disagreement is submitted, the credit scores bureau will certainly explore the insurance claim, usually within 30 days. Keeping precise records throughout this procedure is crucial for effective resolution and tracking your credit history wellness.

Structure a Strong Debt Profile

How can individuals efficiently cultivate a robust credit profile? Building a solid credit rating profile is important for protecting positive monetary chances. The foundation of a healthy credit history profile starts with prompt costs settlements. Continually paying credit card costs, lendings, and other commitments promptly is critical, as repayment history significantly influences credit report.

Furthermore, maintaining reduced credit scores application ratios-- preferably under 30%-- is crucial. This indicates keeping charge card equilibriums well below their limitations. Expanding credit report types, such as a mix of revolving credit (credit score cards) and installment finances (car or home mortgage), can likewise boost credit scores accounts.

Frequently keeping track of debt reports for mistakes is just as important. Individuals must evaluate their credit rating reports a minimum of each year to determine disparities and dispute any errors immediately. In addition, staying clear of excessive credit history questions can protect against potential unfavorable influence on credit rating.

Long-term Benefits of Credit History Repair Service

Moreover, a stronger credit score profile can facilitate far better terms for insurance coverage premiums and also influence rental applications, making it less complicated to protect housing. The mental benefits need to not be forgotten; individuals that successfully fix their credit history frequently experience lowered tension and boosted confidence in handling their finances.

Conclusion

To conclude, debt repair acts as a crucial system for boosting economic health. By identifying and contesting mistakes in debt records, people can fix mistakes that negatively affect their credit score ratings. Establishing audio economic techniques further contributes to building a durable credit scores profile. Ultimately, effective credit scores repair work not only helps with access to better car loans and lower rates of interest yet likewise promotes long-term financial security, therefore advertising general economic well-being.

The long-term benefits of credit score fixing extend much my explanation beyond simply improved credit history scores; they can considerably boost a person's total economic wellness.

Report this page